Accounting For Debentures Class 12 Notes Accountancy

Issue of Debentures

Meaning of Debentures

It is a long-term security yielding a fixed rate of interest, issued by a company. It is used by the company as a means of raising funds.

The rate of interest at which the debenture is issued with is known as the discount rate or the coupon rate.

Characteristics (features of Debentures)

1. Debenture is an instrument of loan.

2.Debenture has common seal of the company.

3. Debenture is redeemable at a fixed and specified time.

4. Debenture-holders are the creditors of company not owners.

5. Debenture is a form of long-term borrowed capital.

6. Debenture-holders have no right to cast vote in company's general meting.

7. At the time of liquidation, first priority is given to debenture-holders at the time of repayment.

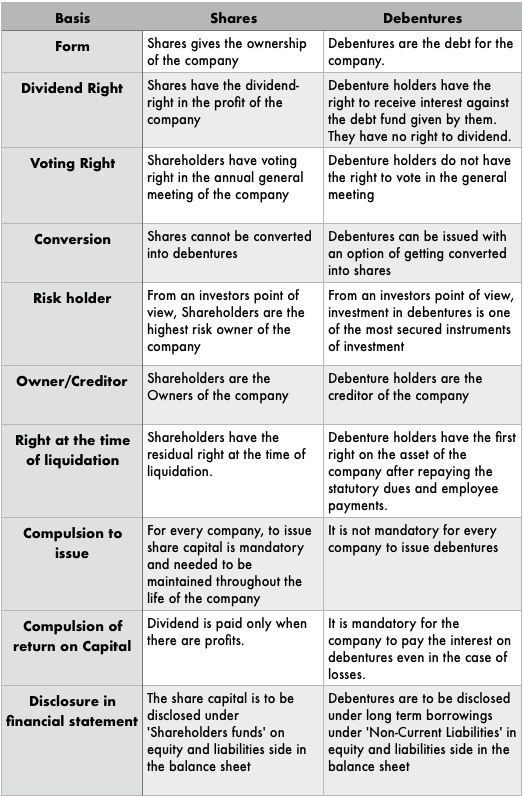

DIFFERENCE BETWEEN SHARES AND DEBENTURES

Issuing Debentures

The debentures are issued in a very much same way the shares are issued. The entries passed are the same except the thing the entries containing the word share capital/ shares would be replace by __% Debentures. The interest rate of debentures is written with the word 'Debentures'.

For example, entry for Debenture Application would be:

Bank A/c Dr.

To 14% Debenture Application A/c

(Being Application money received)

then,

14% Debenture Application A/c Dr.

To 14% Debentures A/c

(Being application money transferred)

The debentures can be issued at par, premium and discount.

In the case of Debentures issued at premium, the premium is credited of Securities Premium Reserve A/c like in the case of shares because both Shares and Debentures fall under the category of Securities.

'Securities Premium Reserve A/c' is shown under the head 'Reserves and Surplus' on the Equity and Liabilities side if the balance sheet.

Issuing debentures at a Discount

According to the Companies Act, a company can issue debentures at a discount unlike shares.

Treatment of Loss/Discount on Issue of debentures

According to AS-16, the discount/loss on issue of debentures should be amortized over the loan period. The unamortized portion of such loss/discount will be shown on the assets side of the balance sheet under the head 'Current Assets' (if the amount is to be amortized in the next 12 months) or 'Non-Current Assets' (if the amount is to be amortized in more than the next 12 months).

Discount is generally recorded in the Allotment entry.

For example, if the Discount or Loss on issue of Debentures is ₹5,00,000 and it is to be written off in the next 5 years, then:

- ₹1,00,000 will be debited to the Statement of Profit & Loss of current year,

- ₹1,00,000 will be shown under 'Other Current Assets',

- and the balance ₹3,00,000 will be shown under 'Other Non-Current Assets'.

Journal entries:

When discount is recorded in the books:

Discount/Loss on issue on debentures A/c Dr. (Amount of discount on the debentures)

To __% Debentures A/c

When discount is written off in the books:

The discount can be written off using the Securities Premium Reserve (if any) (because it is one of the specified uses of the Securities Premium Reserve)

The entry would be:

Securities Premium Reserve A/c Dr. (First preference to write off discount)

Statement of Profit & Loss Dr. (the balance of the discount left to be written off after utilizing the Securities Premium Reserve Account)

To Discount/Loss on issue on debentures A/c

Issue of Debentures for consideration other than cash:

The company can issue debentures other than cash as well. Following entries must be passed when the debentures are issued for consideration other than cash:

- Issue of debentures for purchase of assets:

- When assets are purchased from the vendor:

Assets A/c Dr.

To Vendor's A/c

- When debentures are issued to Vendors:

- If debentures are issued at par:

Vendor's A/c Dr.

To Debentures A/c

- If debentures are issued at premium:

Vendor's A/c Dr.

To Debentures A/c

To Securities Premium Reserve A/c

- If debentures are issued at par:

Vendor's A/c Dr.

Discount on Issue of Debentures A/c Dr.

To Debentures A/c

When the Purchase Consideration is already given in the question, then the following entry is passed:

Sundry Assets A/c Dr.

Goodwill A/c (balancing figure when debit side is short) Dr.

To Sundry Liabilities

To Vendor's A/c

To Capital reserve A/c (balancing figure when credit side is short)

(Being purchase of Business from the vendor)

Issue of Debentures as a Collateral Security

Case 1: When no entry is passed for debentures

Only the entry of the Loan is passed in the books:

Bank A/c Dr.

To Bank Loan A/c

Case 2: When entry is passed for issuing debentures as a collateral

- On taking the loan from the bank:

Bank A/c Dr.

To Bank Loan A/c

- On issuing debentures as collateral security:

Debentures Suspense A/c Dr.

To Debentures A/c

Redemption of Debentures

When the debentures are re-payed, they are known to have got redeemed. This is known as the redemption of debentures.

Step 1: The liability towards the debenture holders is ascertained-

Debentures A/c Dr.

To Debentureholders A/c

Step 2: The debentureholders are paid off-

Debentureholders A/c Dr.

To Bank A/c

But, there may arise 6 cases in the terms of redemption of debentures (since the concept will be explained in one single entry, we'll use a single joint account named 'Debenture Application and Allotment):

- Debentures issued at par and redeemable at par

Say, when the face value= issue price= redeemable value= ₹100

Entry at the time of issue:

Bank A/c Dr. ₹100

To Debenture application and allotment A/c ₹100

Debenture application and allotment A/c Dr. ₹100

To Debentures A/c ₹100

Entry for redemption:

Debentures A/c Dr. ₹100

To Debentureholders A/c ₹100

Debentureholders A/c Dr. ₹100

To Bank A/c ₹100

- Debentures issued at discount and redeemable at par:

Say, the Face value= ₹100, Issue price= ₹90 and redeemable at ₹100

Entry at the time of issue:

Bank A/c Dr. ₹90

To Debenture application and allotment A/c ₹90

Debenture application and allotment A/c Dr. ₹90

Discount on Issue of Debentures A/c Dr. ₹10

To Debentures A/c ₹100

Entry for redemption:

Debentures A/c Dr. ₹100

To Debentureholders A/c ₹100

Debentureholders A/c Dr. ₹100

To Bank A/c ₹100

- Debentures issued at premium and redeemable at par:

Say, the Face value= ₹100, Issue price= ₹110 and redeemable at ₹100

Entry at the time of issue:

Bank A/c Dr. ₹110

To Debenture application and allotment A/c ₹110

Debenture application and allotment A/c Dr. ₹110

To Debentures A/c ₹100

To Securities Premium Reserve A/c ₹10

Entry for redemption:

Debentures A/c Dr. ₹100

To Debentureholders A/c ₹100

Debentureholders A/c Dr. ₹100

To Bank A/c ₹100

- Debentures issued at par and redeemable at premium:

Say, the Face value= ₹100, Issue price= ₹100 and redeemable at ₹110

Entry at the time of issue:

Bank A/c Dr. ₹100

To Debenture application and allotment A/c ₹100

Debenture application and allotment A/c Dr. ₹100

Loss on Issue of Debentures A/c Dr. ₹10

To Debentures A/c ₹100

To Premium on redemption of Debentures A/c ₹10

Entry for redemption:

Debentures A/c Dr. ₹100

Premium on redemption of Debentures A/c Dr. ₹10

To Debentureholders A/c ₹110

Debentureholders A/c Dr. ₹110

To Bank A/c ₹110

- Debentures issued at discount and redeemable at premium:

Say, the Face value= ₹100, Issue price= ₹95 and redeemable at ₹110

Entry at the time of issue:

Bank A/c Dr. ₹95

To Debenture application and allotment A/c ₹95

Debenture application and allotment A/c Dr. ₹95

Loss on Issue of Debentures A/c Dr. ₹15

To Debentures A/c ₹100

To Premium on redemption of Debentures A/c ₹10

Entry for redemption:

Debentures A/c Dr. ₹110

Premium on redemption of Debentures A/c Dr. ₹10

To Debentureholders A/c ₹110

Debentureholders A/c Dr. ₹110

To Bank A/c ₹110

- Debentures issued at premium and redeemable at premium:

Say, the Face value= ₹100, Issue price= ₹105 and redeemable at ₹110

Entry at the time of issue:

Bank A/c Dr. ₹105

To Debenture application and allotment A/c ₹105

Debenture application and allotment A/c Dr. ₹105

Loss on Issue of Debentures A/c Dr. ₹10

To Debentures A/c ₹100

To Securities Premium Reserve A/c ₹5

To Premium on redemption of Debentures A/c ₹10

Entry for redemption:

Debentures A/c Dr. ₹100

Premium on redemption of Debentures A/c Dr. ₹10

To Debentureholders A/c ₹110

Debentureholders A/c Dr. ₹110

To Bank A/c ₹110

It is the annual return of the debentureholder and a charge against profits. Hence, it is to be paid even in the case of Losses.

Notes:

- Discount on issue of Debentures is a capital loss and will be written off during the life time of the debentures. The unamortized parts will be shown on the Assets side of the balance sheet as Unamortized expenses.

- Loss on issue of debentures can be written off from Securities Premium reserve. And the balance of the loss can be written off from Statement of Profit and Loss. Loss on issue of Debentures is a capital loss and will be written off during the life time of the debentures. The unamortized parts will be shown on the Assets side of the balance sheet as Unamortized expenses.

- Premium on redemption of debentures A/c is a liability of the firm, and will be shown under the head 'Non-Current liabilities' under the sub-head 'Other Long-term Liabilities' on the Equity and Liabilities side of the firm.

Interest on Debentures

It is the annual return of the debenture holder and a charge against profits. Hence, it is to be paid even in the case of Losses.

- Interest Accrued and Due:

When the interest is accrued and the company has also become liable to pay it.

- Interest Accrued but not Due:

When the interest is accrued and the company has also become liable to pay it.

Journal entries:

Interest on Debentures A/c Dr.

To Debentureholders A/c

To TDS payable A/c

(Being interest and tax deducted at source due)

Debentureholders A/c Dr.

To Bank A/c

(Payment of Interest)

TDS Payable A/c Dr.

To Bank A/c

(Being TDS paid)

Statement of Profit and Loss A/c Dr.

To Interest on Debentures A/c

(Being interest charged to Statement ofProfit and Loss)

Writing off Discount/Loss on Issue of Debentures:

First preference - Capital Reserve A/c

Then (second preference) - Securities Premium Reserve A/c

And then the balance from (final preference) - Statement of Profit and Loss