Accounting Ratios - CBSE Notes for Class-12 Accountancy

Accounting Ratios

Meaning:

The quantitative relation between two amounts showing the number of times one value contains or is contained within the other.

A ratio may be expressed in the following ways:

(1) 'Proportion' or Pure Ratio or Simple Ratio:

It is the division of one number with the other and expressing in the lowest form of divisibility. The numbers are related with a ':' sign. For example, a simple ratio of Current Assets (say, ₹3,00,000 and Current Liabilities (say, ₹1,50,000) will be 3,00,000:1,50,000 i.e. in the lowest/simplest form 2:1 (Two is to one)

(2) Rate or So many times:

In this we find out that 'how many times' one number is, in comparison to another number.

For example, if we compare 10 and 5, so we may say: 10/5=2 i.e. 10 is 2 times 5.

(3) Percentage:

Example: Gross Profit= ₹2,00,000 and Sales=₹10,00,000 then, GP ratio=₹2,00,000/₹10,00,000 X 100= 20%

(4) Fraction:

Example: Gross Profit= ₹2,00,000 and Sales=₹12,00,000 then, we may say Gross Profit is one-sixth of Sales.

Now, if we talk about firms, then there are two types of ratio analysis involved viz. Cross-sectional analysis (when the data/ratios of one firm is compared with other firms) and Time-series or trend analysis (when the data/ratios of the same firm is compared over various time periods like ratios of 2017, 2018 and 2019 are compared).

Classification of Ratios:

- Liquidity Ratios

- Solvency Ratios

- Activity or Turnover Ratios

- Profitability or Income Ratios

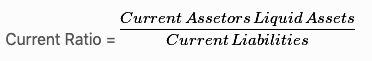

Liquidity Ratios:

Liquidity refers to the ability of a firm to meet its current liabilities. They are also known as 'Short-term Solvency ratios'.

It includes 2 ratios:

- Current Ratio or Working capital ratio

- Quick Ratio or Liquid Ratio or Acid Test Ratio

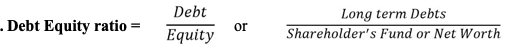

Solvency Ratios:

These ratios reveal the long term solvency of the firm.

They include the following ratios:

- Debt Equity ratio

- Total Assets to Debt Ratio

- Proprietary Ratio

- Interest Coverage Ratio

Activity Ratios:

They are also known as 'Turnover Ratios' because they are calculated on the basis of 'Cost of Revenue from operations' or 'Revenue from operations'.

They include the following ratios:

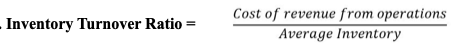

- Inventory Turnover Ratio or Stock Turnover Ratio

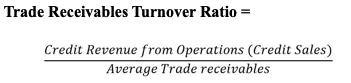

- Debtors or Receivables Turnover Ratio

- Creditors or Payables Turnover Ratio

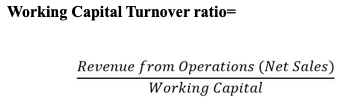

- Working Capital Turnover Ratio

Profitability Ratios or Income Ratios:

These ratios measure the Proportion of profitability with respect to various profit centres i.e. items that affect the profitability of the firm.

They include the following ratios:

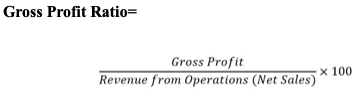

- Gross Profit ratio

- Operating ratio

- Operating Profit ratio

- Net Profit ratio

- Return on Investment or R.O.I

The ideal ratio is 2:1. If it is more, it is considered as better. If the ratio is less than 2:1, then it indicates that there is a shortage of Working capital.

Liquid Assets = Current Assets- Inventories- Prepaid Expenses and Advance Tax.

Or

= Current Investments + Trade Receivables + Cash and Cash Equivalents + Short term Loans and Advances

The ideal ratio is 1:1. If it is more, it is considered as better. If the ratio is less than 1:1, then it indicates that the short term financial position of the company is not good.

Note: Provision for Doubtful Debts is reduced from Trade Receivables while calculating Current and Quick ratio.

Long term Debts include long term borrowings and long term provisions maturing after one year. For example, Debentures, Bank Loan,etc.

Shareholder's Fund = Share Capital + Reserves and Surplus OR

= Non-Current assets + Current Assets - Current liabilities - Non Current Liabilities

{Also, Current Assets - Current liabilities = Working Capital}

Share Capital = Equity + preference shares

The ideal Debt-Equity ratio is 2:1. If it is more than that, then the financial position of the firm is risky. Hence, the lower the ratio, the better it is for the long term lenders.

It ascertains the soundness of the long term policies of the firm. This ratio indicates how much of total assets have been financed by long-term debts.

A higher ratio indicates that assets have been mainly financed by owners funds and less of long-term debts.

Shareholder's Fund is also known as Proprietor's Fund

Total Assets= Non Current Assets + Current Assets

This ratio shows the proportion of total assets funded by owners or shareholders.

Higher the ratio, the better it is. It is usually expressed in percentage.

It is expressed in 'TIMES'. It is also known as Debt Service Ratio. The higher the ratio, the better it is. a high ratio provides a sense of security to the lender with respect to interest payments.

Net profit after tax means Net Profit after Interest and tax because tax is deducted only after deduction of Interest. Hence, profit after tax means that the interest is already subtracted.

Cost of revenue from operations is also known as Cost of Goods Sold.

It is calculated in 'TIMES'. The Inventory Turnover Ratio provides insight on how long cash is tied up in the cycle of being used to purchase raw materials or a finished product for sale through to selling the product. The higher the ratio, the better it is.

Cost of revenue from operations=

Revenue from operations- Gross Profit

OR

Revenue from Operations + Gross Loss

OR

Opening Inventory + Purchases + Carriage + Wages + Other Direct Expenses - Closing Inventory

It is calculated in 'TIMES'. It measures how many times a business can turn its accounts receivable into cash during a period. In other words, the accounts receivable turnover ratio measures how many times a business can collect its average accounts receivable during the year. The higher the ratio, the better it is. If the amount of credit Revenue from operations isn't given in the question and it can't be found out using the values in the question, then the ratio may be calculated on the basis of Total Revenue from operations.

It is calculated in 'TIMES'. If the amount if credit purchases isn't given in the question and it can't be found out using the values in the question, then the ratio may be calculated on the basis of Total Purchases. It shows a company’s ability to pay off its accounts payable by comparing net credit purchases to the average accounts payable during a period. In other words, the accounts payable turnover ratio is how many times a company can pay off its average accounts payable balance during the course of a year.

It is calculated in 'Times'. Working capital is current assets minus current liabilities. A high turnover ratio indicates that management is being extremely efficient in using a firm's short-term assets and liabilities to support sales. Conversely, a low ratio indicates that a business is investing in too many accounts receivable and inventory assets to support its sales, which could eventually lead to an excessive amount of bad debts and obsolete inventory write-offs.

A higher ratio is considered better. The ratio can be used to test the business condition by comparing it with past years’ ratio and with the ratio of other companies in the industry. A consistent improvement in gross profit ratio over the past years is the indication of continuous improvement .

Gross Profit = Revenue from Operations - Cost of Revenue from Operations

Cost of Revenue from Operations = Opening Inventory + Net Purchases + Carriage + Wages + Other Direct Expenses - Closing Inventory

Note: Spare parts and Loose Tools are not included in Inventory

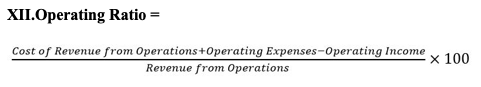

Operating Expenses = Employee Benefit expenses + Depreciation and Amortization expenses+ Other expenses ( like Office and Administration expenses + Selling and distribution expenses+ Discount + Bad-debts+ Interest on short-term loans)

{In short, Operating expenses are those expenses which are incurred in the day to day operations of the company}

Operating Income = Trading commission received, Cash Discount Received

The operating ratio is used to measure the operational efficiency of the management. It shows whether or not the cost component in the sales figure is within the normal range. A low operating ratio means a high net profit ratio (i.e., more operating profit) and vice versa.

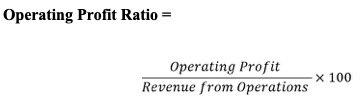

Operating Profit = Gross profit - operating expenses + Operating Incomes

OR

Operating Profit = Net profit (before tax) + Non Operating expenses (like Loss on sale of fixed assets, loss from fire, income tax, finance charges relating to interest on long term debts, interest on debentures, etc.) - Non Operating Incomes (like Profit on sale of fixed assets, Interest and dividend received on investments, etc.)

A company with higher operating margin ratio is financially sound. It can easily pay its fixed costs and interest on the debt. A company with good operating ratio can successfully survive during an economic crisis. Only a company with higher operating margin ratio can successfully compete with the competitors by lowering the price of products to such level that competitors will not be able to survive.

Note: Operating Ratio + Operating Profit Ratio = 100%

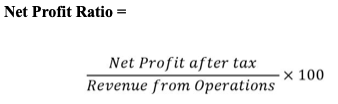

Net Profit = Gross Profit - Indirect Expenses and losses + Other Incomes - Tax

Indirect Expenses and losses = Office expenses + Selling expenses+ Interest on Long term Borrowings + Accidental Losses + Other indirect expenses

As such, it is one of the best measures of the overall results of a firm. The measure is commonly reported to judge performance over time. It is also used to compare the results of a business with its competitors.

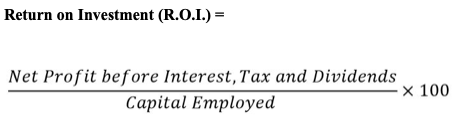

It is also known as 'Rate of Return' or 'Yield on Capital' or 'Return on Capital Employed'.

Return on investment (ROI) measures the gain or loss generated on an investment relative to the amount of money invested. ROI is usually expressed as a percentage and is typically used for personal financial decisions, to compare a company's profitability or to compare the efficiency of different investments.