Cash Flow Statement - CBSE Notes for Class 12 Accountancy

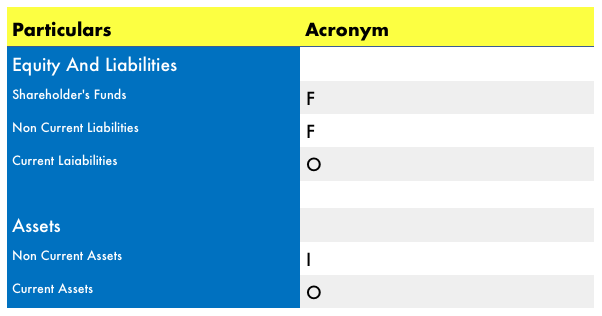

1) The Acronym 'FFO IO' Helps To Identify the effect of a Particular Head on The Type of Activity Under Cash Flow Statement.

Example:- The financing Activities would be affected by the changes by the changes of Shareholder's Funds and Non-current Liabilities as per the rule of 'FFO IO'.

2) Marketable Securities, Bank Overdraft and Demand Deposits/ Cash /Bank Balances:

1. Cash and Bank Balances - The sum of their opening Balances Creates 'Opening Cash and Cash Equivalents.'

> The Sum of Their Closing Balances Would Create 'Closing Cash and Cash Equivalents'.

2. Marketable Securities are Added in the Opening Balance of Cash and Cash Equivalents.

3. Bank Overdraft should never be treated as a Current Liability in the Cash Flow Statement, its Net Effect is shown under Cash flow from Financing Activity.

4. Demand Deposits have the same treatment as that of marketable securities.

3) Calculation of Net Profit Before Tax and Extraordinary Items

-With Adjustments : The calculation is Complex and Requires Preparation of Accounts.

-Without Adjustments :The Calculation is easy and requires simple addition.

With Adjustments :

To be discussed later, The Concepts of Account Preparation needs to be understood first.

Without Adjustments :

Net Profit ( Current year - Previous Year )

ADD : Increase in Reserves

ADD : Provision for Tax ( Current year )

ADD : Proposed Dividend ( Current Year )

LESS : Tax Refund

= Net profit Before Tax

4) Preparation of Accounts :

> If any item is provided in the balance sheet and the adjustments for the same are available as well, the Preparation of accounts for the same becomes Mandatory.

> Some of the accounts that are important from exam point of view and may be prepared necessarily :

1. Provision for Tax Account

2. Asset Account

3. Proposed Dividend Account

4. Accumulated Depreciation Account

- Provision For Tax Account

|

Provision for Tax A/C |

|||

|

Particulars |

Amount |

Particulars |

Amount |

|

Bank A/C [ - From Cash Gen. From Operations ] |

X |

Balance B/d ( Previous Year ) |

X |

|

Balance C/d |

X |

Statement of P&L ( + Net Profit Before Tax* ) |

X |

|

XX |

XX |

||