Financial Statements Of A Company Class 12 Notes Accountancy

Financial Statements of Companies

Meaning of a Financial year:

Period from 1st April to 31st March

Meaning of a Financial statements:

Definition of Financial Statements as per Section 2(40) of Indian Companies Act 2013-

Section (40), financial statements in relation to a company, includes the following:

(i) a balance sheet as at the end of the financial year;

(ii) a profit and loss account, or in the case of a company carrying on any activity not for profit, an income and expenditure account for the financial year;

(iii) cash flow statement for the financial year;

(iv) a statement of changes in equity, if applicable; and

(v) any explanatory notes

The financial statements, of One Person Company, small company and dormant company, may not include the cash flow statement.

Objectives of Financial Statements:

- Financial statements show an accurate state of a company’s financial position (i.e. economic assets and liabilities).

- They present a true and fair view of the financial performance (i.e. profit/loss) of the business.

- Financial statements of a company depict the effectiveness of its management. How well a company is performing depends on its profitability, which these statements show.

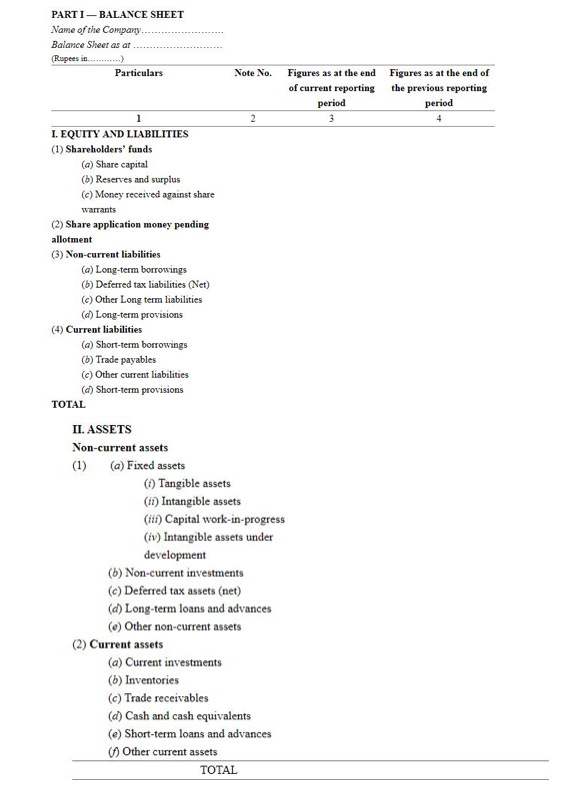

Schedule III for preparing Balance Sheet and Statement of Profit and Loss

This format of the Balance sheet needs to be memorized by the students. The order of the appearance of the items can't be changed.

Notes:

- No debit balance of profit and loss is shown on the assets side of the Balance Sheet. It is shown under Reserves and Surplus as a negative balance on the Liabilities side of the balance sheet.

- While preparing balance sheet, the date of the balance sheet will be stated by using the word 'AT' instead of 'on'.

- An asset or liability can be classified as current if it satisfies any of the following conditions:

- It is expected to be realized/settled in the company's normal operating cycle,

- It is held mainly for being traded.

- it is expected to be realized/settled within 12 months after the reporting date.

OPERATING CYCLE: It is the time period between the acquisition of assets for processing and their realisation in cash or cash equivalents. It can be more or less than 12 months. If normal operating cycle can't be identified, then it is assumed to be of 12 months.

Hence, if operating cycle>12 months, then the time period for classification of an asset or liability to be current will be seen according to the realisation/settlement within the time period of the operating cycle.

And, if operating cycle<12 months, then the time period for classification of an asset or liability to be current will be seen according to the realisation/settlement within the 12 months time period.

Explanation of items of balance sheet:

(I) Equities and Liabilities-

(1) Shareholder's Fund:

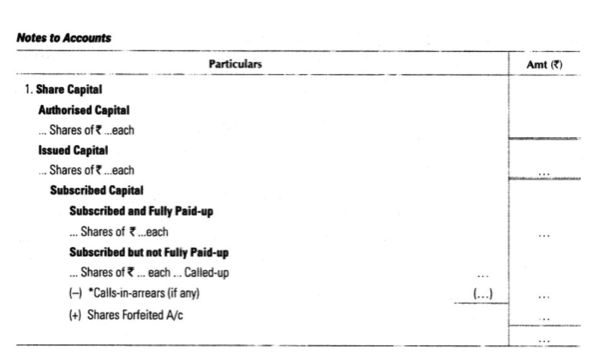

(A) Share Capital:

Presentation of Share Capital in Company's Balance Sheet

|

Particulars |

Note Number |

Amount (Current Year) |

Amount (Previous Year) |

|

I. EQUITY AND LIABILITIES: |

|||

|

(a) Shareholder's Fund: |

|||

|

1. Share capital |

(1) |

XXX |

|

|

2. Reserves and Surplus |

XXX |

||

|

3. Money received against share warrants |

XXX |

(a) Authorised Capital: It is the amount stated in the Memorandum of Association. It is the maximum limit of Capital that a company is authorised to issue as shares during the lifetime of a company.

(b) Issued Capital: It is a part of Authorised Capital which the company has offered to the public for subscription.

Note: Authorised and issued capital is not added to the total, it is shown for information purposes only.

(c) Subscribed Capital: It is a part of Issued Capital that has been subscribed by the public. It further has 2 heads:

(i) Subscribed and fully paid up: When whole of subscribed capital is called up by the company and also paid by the shareholders.

(ii) Subscribed but not fully paid up:

- When the company has not called up the full nominal value of the share; OR

- When the company has called up the full nominal value of the share but the shareholder has not paid some part of the called up value.

(B) Reserves and Surplus:

All the Reserves like general reserves, capital reserves, etc. is shown under this head.

(C) Money received against share warrants:

It is an instrument against which the holder acquires a right to get some shares of the company at a later date.

(2) Share Application Money pending Allotment: (not in syllabus)

Share Application Money Pending Allotment means the amount received on the application, on which allotment is not yet made (pending allotment).

(3) Non-Current liabilities:

The are those liabilities which are not current liabilities.

They are further classified into:

(A) Long-term Borrowings:

These are the borrowings which are payable by the company after 12 months from the date of loan. Some part of the long-term borrowings may be payable with the next 12 months. The amount such due will be shown under 'Other Current Liabilities' as Current Maturities of Long term Debts.

(B) Deferred tax liabilities: (not in syllabus)

When accounting income is more than the taxable income.

(C) Other Long-term Liabilities: (not in syllabus)

The liabilities which are Non-Current in nature and don't go in any other head. For example, Premium payable on redemption of debentures.

(D) Long-term Provisions:

Provisions related to items to be settled after 12 months. For example,Provision for gratuity.

(4) Current liabilities:

(A) Short-term Borrowings:

Borrowings which are due for payment within 12 months from the date of loan. For example, Bank Overdraft.

(B) Trade Payables:

These liabilities are trade liabilities which arise on account of goods purchased or services received in the normal course of business.For example, Sundry creditors and Bills Payables.

(C) Other Current liabilities:

The liabilities which are Current in nature and don't go in any other head. For example, Unpaid dividends, Income received in advance, Current maturities of Long term debts etc.

(D) Short-term provisions:

These are the provisions made against the liabilities which can arise within the next 12 months from the date of balance sheet. For example, Provision for doubtful debts.

(II) Assets-

(1) Non- Current Assets:

(A) Fixed Assets:

Assets held for continuous use and not meant for sale. the can be further classified into:

(i) Tangible Assets: Assets which can be physically seen and touched.

(ii) Intangible Assets: Assets which cannot be physically seen or touched.

(iii) Capital Work-in-Progress (not in syllabus): These are the tangible assets under construction

(iv) Intangible Assets under Development (not in syllabus): These are the intangible assets which are under development, like research being undertaken which can result into a patent.

(B) Non-current investments:

Investments that are made for one than one year. The company does not intend to sell them in the next 12 months.

(C) Deferred Tax Assets (not in syllabus):

When accounting income is less than the taxable income.

(D) Long-term loans and advances:

These are those advances which are expected to be received back after 12 months. For example, Capital Advances and Security Deposits.

(E) Other non-current assets:

All other Non-Current assets which do not fall under any other head, come under this head. For example, Discount or loss on issue of debentures.

(2) Current Assets:

(A) Current investments:

Investments that are made for less than one year. The company intends to sell them in the next 12 months.

(B) Inventories:

Inventories means the stock held for the purpose of gtrade in the normal course of business.

(C) Trade receivables:

Trade Receivables arise due to the selling of the goods and services by a company to its Customers on credit.

(D) Cash and cash equivalents:

Cash equivalents are short-term, highly liquid investments with a maturity date that is 3 months or less from the time of purchase. They include the following:

- Cash in hand

- Cash at Bank

- Cheques and drafts on hand

- Others (expected to be realised within 3 months like Marketable Securities)

(E) Short-term loans and advances:

These are those advances which are expected to be received back within 12 months.

(F) Other current assets:

All other Current assets which do not fall under any other head, come under this head. For example, Unamortised Expenses to be written off within 12 months from the date of balance sheet.

(III) Contingent Liabilities:

These are the liabilities which may arise in future on happening of a certain event. For example, Claims against the company in a lawsuit.

Part II

Form of Statement of Profit and Loss

|

S.No. |

Particulars |

Note Number |

Figures for the Current Reporting Period |

Figures for the Previous Reporting Period |

|

1 |

Revenue from operations |

|||

|

2 |

Other Income |

|||

|

3 |

Total Revenue ( 1 + 2 ) |

|||

|

4 |

Expenses : Cost of Materials Consumed Purchase of Stock In Trade Changes in Inventories of stock in trade, finished goods and work in progress Employee benefit expenses Depreciation and Amortisation expenses Other expenses |

|||

|

Total expenses |

||||

|

5 |

Profit before tax (3 - 4) |

|||

|

6 |

Tax |

|||

|

7 |

Profit after tax ( 5 - 6 ) |

(1) Revenue From Operations :

It is the revenue earned from business operations. It would be shown in the notes to accounts as :

a) Revenue from sale of products: xxx

Less: Returns ( xxx)

Net revenue xxx

b) Revenue from sale of services

c) Other operating incomes such as sale of scrap

(2) Other Income :

Incomes/revenues which are not generated through main business activities. Example, Interest and Dividend Income

(3) Cost of Materials Consumed :

Cost of Materials Consumed= Operating Inventory of Materials + Purchases of Materials - Closing Inventory of Materials

Note: Materials like stores, fuel, etc. don't enter physically in the Finished Product. Hence, they are excluded from Raw Materials and are shown under Other Expenses.

(4) Purchase of Stock in Trade :

These are the goods purchased which are further resold.

(5) Changes in Inventories of stock in trade, finished goods and work in progress :

- Opening Inventories of stock in trade xxx

Less: Closing Inventories of stock in trade (xxx) xxxx

- Opening Inventories of work in progress xxx

Less: Closing Inventories of work in progress (xxx) xxxx

- Opening Inventories of finished goods xxx

Less: Closing Inventories of finished goods (xxx) xxxx

Total (A+B+C) xxxx

(6) Employee Benefit Expenses :

It includes items like Wages, Salaries, Bonus and leave encashment, contribution to provident fund, staff welfare expenses, etc.

(7) Finance Costs :

It includes Interest expenses (Interest on Overdraft, Interest on Overdraft) and other borrowing costs (Discount or Loss on Issue of Debentures written off, Premium payable on redemption of debentures written off).

(8) Depreciation (charged on tangible assets) and Amortization Expenses (charged on intangible assets)

(9) Other Expenses :

All other expenses which cannot be appropriated to any of the above heads, they are put under this head. For example, Freight, Bank Charges, Audit fee, Director's fee, Loss on Sale of Fixed Assets, Share issue expenses written off.