Tools for financial statement analysis Class 12 Notes Accountancy

TOOLS FOR ANALYSIS OF FINANCIAL STATEMENTS :

1) Comparative Statements:

All items are put in a Comparative manner, Comparing the Current Data with Previous Accounting Period Data.

2) Common Size Statements:

In such Statements, The Change is shown in a percentage form taking One of the items as a Base and considering it equal to 100%.

3) Ratio Analysis:

The Accounting Ratio Analysis, helps to understand different aspects of a Business such as its Liquidity and Ownership.

4) Cash Flow Statement:

It is a Comprehensive record of the Cash and Non cash transactions taking place in the business, it finally shows the Cash flow from Different activities.

Comparative Statements

MEANING

Comparative Statements compare the the items in a tabular form taking the Data for 2 year period. Comparative Analysis Is a Part of Horizontal Analysis. It shows the Change in both absolute and Percentage form.

OBJECTIVES/PURPOSES OF COMPARATIVE FINANCIAL STATEMENTS

1) Data Presentation becomes simple and Comparable

Comparative Statements is a simple Statement showing data from multiple periods in a tabular form, Making the Information Siimple To Understand.

2) Brings out Changes in Trends

Since there is Comparison of different phases of a Business, It brings out the trend of the Business and Hence Helps in Forecasting.

3) Strength and Weakness Analysis

The Comparative Statements help in understanding the Strong and Weak points of an Enterprise with Respect to Its Operations.

4) Comparisons

The Firms can easily Compare their Output, using the Comparative Statements. The Data is present in both Percentage as well as Absolute Figures to be Compared.

5) Policy Making

The Results derived from the comparison of different year's Data, Reveals the Fault/Success of Policies and hence Facilitates decision Making.

IMPORTANCE OF COMPARATIVE FINANCIAL STATEMENTS

1) Planning

Since the Comparative Statements bring out the trend of the business it helps in the decision making process.

2) Lenders

The Lenders depend upon the Results of the Comparative Statement Analysis to see Whether their Investment in the firm is Profitable or not.

3) Investors

The Financial documents of a Firm can be studied by anyone from the Common Public, Hence the Investors go through the Comparative Statement to Understand whether their Investment would bear fruits or not.

LIMITATIONS OF COMPARATIVE FINANCIAL STATEMENTS

1) Historical records

These Statements present only the Information of the Past and hence indicate the trend of the Past.

2) Affected by Personal Judgement

A lot many times Digits are Rounded off to get Absolute Figures, Such Personal Changes might bring out absurd Results.

3) Qualitative Elements Ignored

All The Qualitative Elements such as Work Environment and Efficient Management are ignored while preparing such Records.

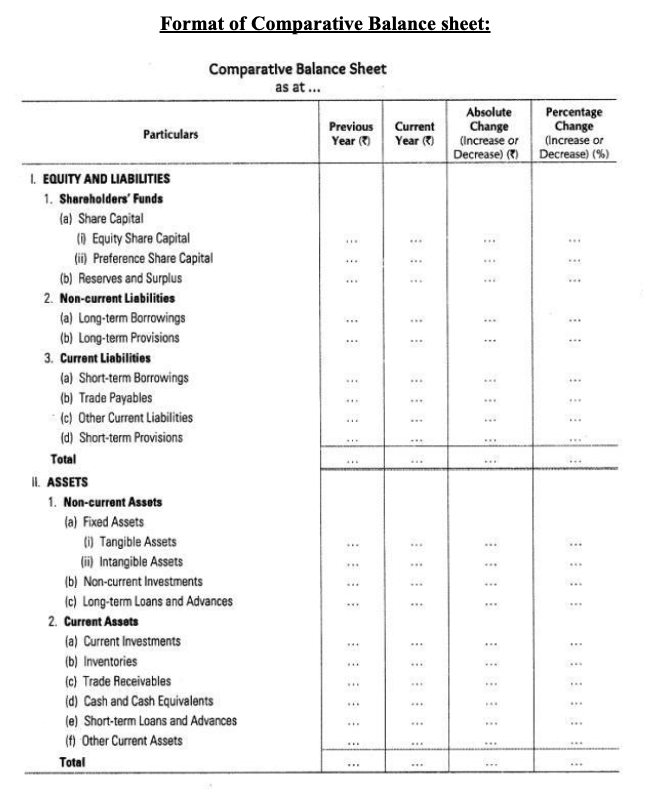

COMPARATIVE BALANCE SHEET

It is a Comparison of the Assets and Liabilities of a Firm Compared through the Balance Sheet Format on Two Different Dates. It is a form of Horizontal Analysis.

ADVANTAGES OF COMPARATIVE BALANCE SHEET

1) Brings out the Real Change

Since Balance Sheet is the Final Statement Prepared, It Brings out the Total Changes Undergone Clearly.

2) Facilitates Planning

The Trend of Different balance sheet heads comes out Clearly hence Bringing out The necessary steps be taken for development via New Policies.

3) Reflects Trend

Since the changes in Both Assets and Liabilities are reflected Clearly, It Brings out the Change of Trend in Different Heads of the Balance sheet.

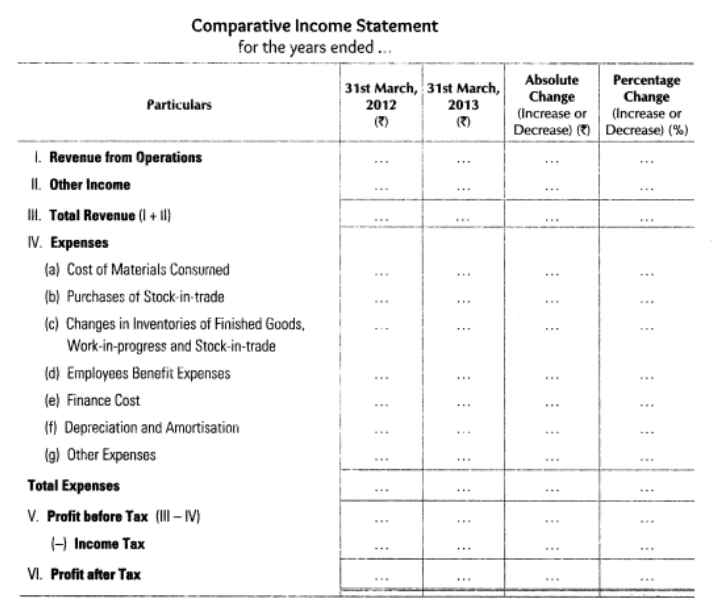

COMPARATIVE STATEMENT OF PROFIT AND LOSS

It is a Horizontal Analysis of the Income Statement showing the Operating Results for more than one Accounting Period in a Tabular Form.

Format of Comparative statement of profit and loss:

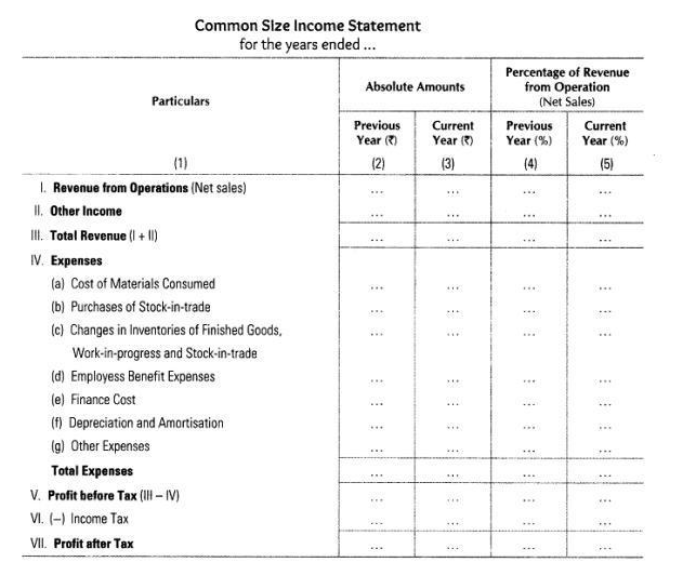

Common Size Statements

It is a Form of Vertical Analysis, In which individual items are written and are Further Converted into Percentages to a Common Base. The Percentages can Be Compared over Different Periods and Conclusions can be drawn.

COMMON SIZE INCOME STATEMENT

In the Common Size Income Statement, all the items are expressed as Percentages and The Base is Taken to Be Revenue from Operations, Whose Percentage Stands at 100.

OBJECTIVES :-

1. Analysing changes in the items of Income Statement

2. Study Trend of Elements of Income Statement

3. Assessing the Efficiency of each Element.

Following is the format of common size statement of profit and loss :

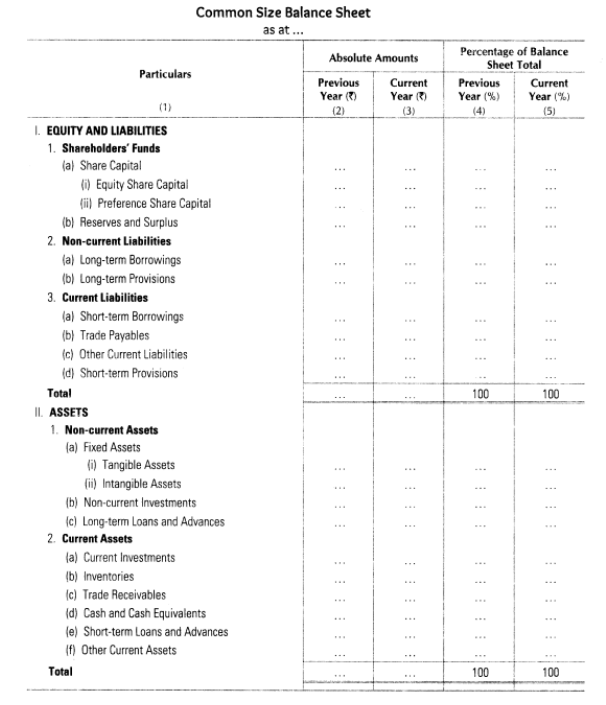

COMMON SIZE BALANCE SHEET

It shows the Percentage Relationship of each asset/liability to the Total. The Percentage of Total is taken to be 100. Comparative Balance Sheet indicates the Trend in Different Items.

OBJECTIVES :-

1. Analysing the changes in different items of Balance sheet

2. See the trend of different items of Assets, Equity and Liabilities.

3. Understand the Financial Strength.

Following is the format of common size Balance Sheet: